All You Need to Know About Canada’s Electric Car Govt. Rebates, Tax and Tax Write-offs

The federal government has declared that by 2035 100 percent of passenger cars and trucks sold in Canada must be zero-emission. But we all know that the higher upfront purchase cost of zero-emission vehicles (ZEVs) can make it more difficult to adopt this clean technology. In order for you to make the switch, both the Federal and provincial government has announced new incentives to make zero-emission vehicles (“ZEV”) more affordable for Canadians. Here is the breakdown of everything you need to know before purchasing ZEV.

BC Govt. Rebate

The iZEV Program offers point-of-sale incentives for consumers who buy or lease a ZEV vehicle.

Here’s the breakdown of the incentive amounts for the purchase or lease of each vehicle type:

- Up to $4,000 for the purchase or lease of a new battery electric vehicle (BEV) or extended-range (ER)-EV.

- Up to $2,000 for the purchase or lease of a new plug-in hybrid electric vehicle (PHEV).

- Up to $4,000 for the purchase or lease of a hydrogen fuel-cell vehicle (FCEV).

To apply for a rebate, you must be a B.C. resident with a valid B.C. driver’s license. The rebate amount is based on your total gross annual income and the type of vehicle you’re buying. If you have an income of $100,001 and above, you’re not eligible for a rebate. Pre-approval for a rebate is required before buying your EV.

Federal Govt. Rebate

There are additional incentives for purchasing an electric vehicle in Canada. Qualifying vehicles (battery electric and longer-range plug-in hybrids) are also eligible for rebates from the federal government, ranging from $2,500 for most PHEVs up to $5,000 for EVs and a few select PHEVs. Vehicles need to have a base model MSRP of $55,000 or less, with higher values qualifying for larger vehicle types.

Federal incentives are in addition to provincial rebates and are also applied at the point of sale.

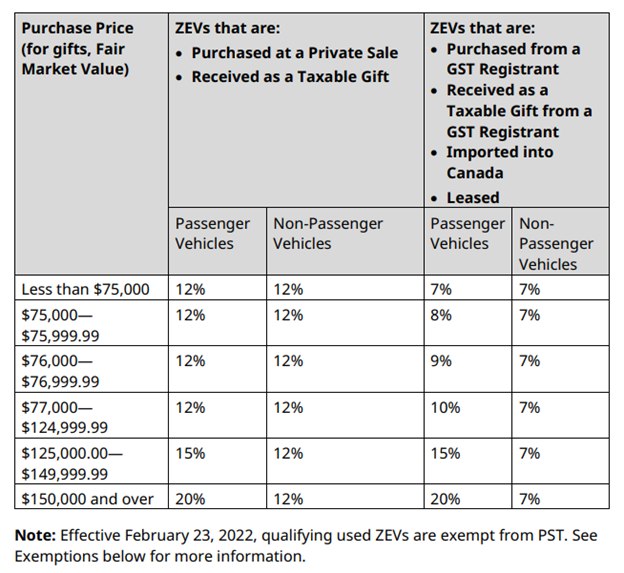

New Passenger Vehicle Surtax Threshold For Zero-Emission Vehicles

Also effective February 23, 2022, the passenger vehicle surtax (luxury tax) threshold for zero-emission vehicles is increased to $75,000 from $55,000. The increased surtax threshold is scheduled to end on February 22, 2027. This change is intended to accommodate the typically higher capital cost of a ZEV versus a comparable internal combustion engine alternative.

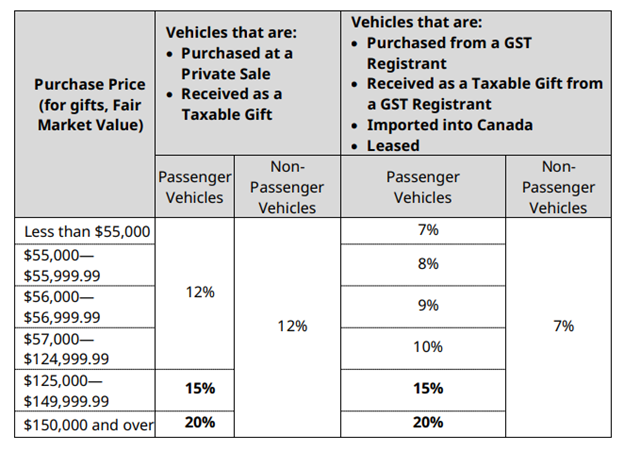

Table 1: PST Rates for Vehicles (For zero-emission vehicles acquired after February 22, 2022, see Table 2 below)

Table 1: PST Rates for Vehicles (For zero-emission vehicles acquired after February 22, 2022, see Table 2 below)

Used Zero-Emission Vehicles (ZEVs) Tax Exemption

Effective February 23, 2022, used zero-emission vehicles are exempt from provincial sales tax (PST). The exemption applies to sales of all used zero-emission vehicles from motor dealers and private sales of used zero-emission vehicles that have been driven for at least 6,000 kilometers. The exemption is set to apply for five years, expiring on February 22, 2027, and is intended to encourage consumers to adopt ZEVs.

The exemption will be provided:

- By the motor vehicle dealer or leasing company at the time of sale or lease of qualifying used ZEV, or

- By ICBC at the time of registration for a qualifying ZEV purchased privately in B.C. or imported into B.C.

Tax Write-Offs

Two new CCA classes have been created for zero-emission vehicles acquired after March 18, 2019, and become available for use before 2028.

- Class 54 motor vehicles and passenger vehicles excluding taxicabs and automobiles used for lease and rent: The CCA rate for this class is 30% but a higher deduction (up to a maximum of 100%) may apply for certain eligible vehicles acquired after March 18, 2019 and before January 1, 2028 (phase out starting in 2024).

- Class 55 for automobiles for lease or rent and taxicabs: The CCA rate for this class is 40%, but a higher deduction (up to a maximum of 100%) may apply for certain eligible vehicles acquired and available for use after March 18, 2019 and before January 1, 2028 (phase out starting in 2024).